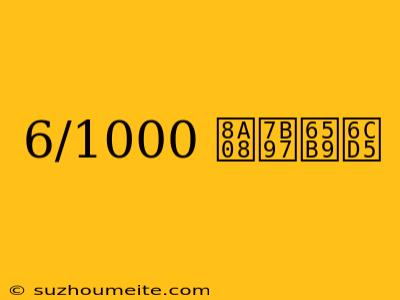

6/1000 計算方法

What is 6/1000 calculation method?

The 6/1000 calculation method is a widely used technique in various fields such as finance, economics, and business to calculate the interest rate or return on investment (ROI) of a particular investment or loan. The method is simple and easy to apply, making it a popular choice among professionals and individuals alike.

How to calculate 6/1000?

The 6/1000 calculation method involves a simple formula to calculate the interest rate or ROI of an investment or loan. The formula is as follows:

Interest Rate = (6/1000) x Principal Amount x Time

Where:

- Principal Amount is the initial amount borrowed or invested

- Time is the period of the loan or investment expressed in years

For example, if you borrowed $10,000 for 5 years, the interest rate would be:

Interest Rate = (6/1000) x $10,000 x 5 = $300 per year

Advantages of 6/1000 calculation method

The 6/1000 calculation method has several advantages, including:

Easy to understand and apply

The formula is simple and easy to understand, making it accessible to people with limited mathematical knowledge.

Fast calculation

The method allows for quick calculation of interest rates or ROI, making it ideal for fast-paced business environments.

Wide applications

The 6/1000 calculation method can be applied to various fields, including finance, economics, and business.

Limitations of 6/1000 calculation method

While the 6/1000 calculation method is widely used, it has some limitations, including:

Simplistic approach

The method assumes a fixed interest rate over the entire period, which may not reflect the actual interest rate fluctuations.

Ignores compounding effect

The method does not take into account the compounding effect of interest, which can result in inaccurate calculations.

Conclusion

The 6/1000 calculation method is a simple and widely used technique to calculate interest rates or ROI of investments or loans. While it has its advantages, it also has limitations, and users should be aware of these when applying the method. By understanding the formula and its applications, individuals and professionals can make informed decisions in various fields.